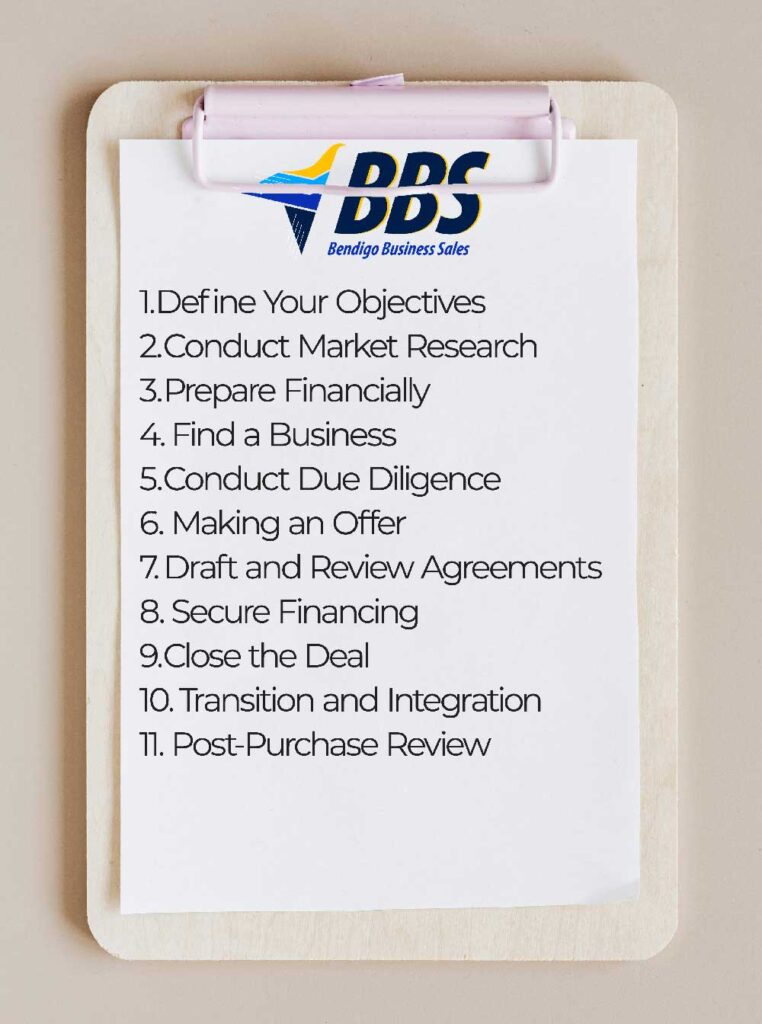

Buying an existing business offers several advantages such as established operations, a customer base, and immediate cash flow. However, before purchasing a small business, it’s crucial to consider numerous business, legal, and financial factors. In this article, we outline 11 key steps to guide you through the process.

- Define Your Objectives:

- Identify what type of business you want to buy based on your interests, skills, and financial capacity.

- Set clear goals and criteria for the acquisition, such as industry, location, size, and budget.

- Conduct Market Research:

- Research potential industries and businesses to understand market conditions, competition, and growth potential.

- Evaluate trends and opportunities in the sector you are interested in.

- Prepare Financially:

- Assess your financial situation and secure financing if needed, which may include personal savings, loans, or investors.

- Consider working with a financial advisor to understand the full financial implications of the purchase.

- Find a Business:

- Look for businesses that fit your criteria through business brokers, online platforms such as Commercial Real Estate or Any Business, industry contacts, or personal networks.

- Evaluate various opportunities and shortlist potential businesses.

- Conduct Due Diligence:

- Expect to sign a Non-Disclosure Agreement (NDA) to access sensitive business information. Review the terms carefully with legal counsel.

- Review financial statements, tax returns, and other critical documents to assess the business’s financial health and identify trends

- Analyse operational aspects, including contracts, inventory, customer base, and employee structure.

- Examining contracts, intellectual property rights, and customer relationships.

- Evaluating risks such as dependency on key personnel or customers.

- Checking online reviews

- Making an Offer:

- Determine your value of the business, often with the help of a business appraiser or accountant. What are you prepared to spend on acquiring this business?

- Make an initial written offer outlining purchase price, structure, proposed settlement date and any conditions.

- Aim for mutual understanding between yourself and the vendor before proceeding to a detailed purchase agreement.

- Draft and Review Agreements:

- Engage an experienced solicitor with expertise in business acquisitions to effectively handle the legal aspects of purchasing a business. Typically, the vendor’s solicitor will be responsible for drafting and finalizing the sale contracts. Your solicitor’s role is to review the contract of sale ensure that the terms of the contract align with your needs and requirements as the buyer.

- Ensure that all terms, including price, payment structure, and contingencies, are clearly defined and meet your requirements.

- Secure Financing:

- Finalize your financing arrangements based on the agreed-upon purchase price and terms.

- Complete any necessary paperwork with lenders or investors.

- Close the Deal:

- Conduct a final review of all documents and agreements.

- Complete the closing process, which includes signing the purchase agreement, transferring funds, and finalizing ownership details.

- Obtain all necessary licenses and permits for operating the business.

- Transition and Integration:

- Work with the seller to ensure a smooth transition, including training, customer handover, and integration of staff and operations.

- Communicate with employees, customers, and suppliers about the change in ownership.

- Post-Purchase Review:

- Evaluate the business’s performance and address any initial challenges or issues.

- Implement your plans for growth and improvement based on your assessment of the business.

Each step may involve additional details depending on the specifics of the business and industry. By systematically addressing these steps, you enhance your readiness to successfully acquire a small business. Each stage requires careful consideration and legal oversight to mitigate risks and maximize your investment’s potential. Working with professionals, such as business brokers, accountants, and legal advisors, can help navigate the complexities and ensure a successful acquisition.